UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

(Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

| Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material |

MSCI Inc.

(Name of Registrant as Specified in itsIn Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Thanother than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): | ||||||

| No fee | ||||||

| required | ||||||

| ☐ | ||||||

| Fee paid previously with preliminary | ||||||

| materials | ||||||

| ☐ | ||||||

| 0-11 | ||||||

Notice of 2018 2022

Annual Meeting of Shareholders and Proxy Statement

Our We strive to bring greater | Bringing clarity to Developnew research and models to help our clients better assess an increasingly complex and expanding global investment landscape Measureand model environmental, social and governance (ESG) and climate risk and opportunities Enhanceour clients’ experience by leveraging technology to easily integrate into client workflows and deliver our solutions across multiple platforms Achieveclient-centricity by understanding our clients’ unique needs in the markets in which they operate and by providing excellent client support Helping the |

| 2022 PROXY STATEMENT | 3 |

Letter from our Chairman and CEO

Looking ahead, we remain focused on being nimble and investing aggressively to meet client demand across the growth opportunities in front of us, including with respect to ESG and climate. 1 Recurring net new sales represent the amount of new recurring subscription sales net of subscription cancellations during the period. | Dear fellow shareholders, | ||

First and foremost, thank you for your continued support of MSCI Inc. (“MSCI” or the “Company”). Thanks to MSCI’s more than 4,000 employees around the world, we delivered exceptional results in 2021, demonstrating the strength of our ambitious strategy, key long-term investments and relentless execution. Delivering Results Our 2021 performance further speaks to the trust our clients place in us to help them navigate an increasingly complex investment landscape and our ability to continue to meet their needs. Among other milestones, at the end of 2021, we achieved record full-year and quarterly recurring sales and recurring net new sales1, along with the 32nd consecutive quarter of double-digit subscription growth in our Index product line. We also affirmed our status as a leading provider of ESG and climate solutions for investors. We saw significant momentum in our ESG and Climate segment, resulting in nearly 50% top-line growth compared to the prior year. Throughout 2021, we rolled out several new climate tools, including an analytical tool that provides carbon emissions data for more than 15,000 private companies and nearly 4,000 active private equity and debt funds. This is in addition to our launch of Climate Lab Enterprise, a first-in-kind visualization dashboard that combines our climate data with our analytical risk and portfolio management capabilities, and the carbon emission data we already provide on nearly 10,000 public companies. In 2021, we also saw a significant expansion of our capabilities with respect to private assets, with the completion of our acquisition of Real Capital Analytics, Inc. (“Real Capital Analytics” or “RCA”), a provider of data and analytics for the properties and transactions that drive the global commercial real estate capital markets. After this and other investments in our business, we returned approximately $440 million of cash to shareholders through a combination of dividends and share repurchases. Positioning MSCI for the Future Looking ahead, we remain focused on being nimble and investing aggressively to meet client demand across the growth opportunities in front of us, including with respect to ESG and climate. The global race | to net-zero keeps accelerating, and we aim to further position MSCI to become the top provider of ESG and climate solutions to the investment industry. We will also continue to invest in our data-transformation strategy. This strategy was a direct result of the feedback we received from many of you. We plan to continue to rapidly incorporate new proprietary and third-party data sets to expand and enrich our existing content in order to generate more meaningful and richer insights for our clients. We are also continuing to create new pathways for clients to access and interact with our products, including by developing and launching our new open-architecture Investment Solutions as a Service (“ISaaS”) offerings, many of which can integrate with our clients’ existing ecosystems via APIs. Doing our Part For the last several years, including by publishing the MSCI Principles of Sustainable Investing, we have been urging all investors to integrate ESG and climate considerations into their investment processes in order to achieve long-term, sustainable investment performance. Since then, we have published reports, data and research to continue to provide clarity for investors so that they can make more informed decisions regarding material environmental, social and governance risks. We have also released tools that can help our clients navigate these efforts – tools that support our mission of enabling investors to build better portfolios for a better world. In 2022, we not only remain deeply committed to this objective, but we also aim to lead by example through our corporate responsibility policies and practices. We Ask for Your Support Your vote is very important to us. We strongly encourage you to read both our Proxy Statement and 2021 Annual Report on Form 10-K in their entirety and ask that you support our recommendations. We sincerely appreciate your continued support of MSCI, and we look forward to the 2022 Annual Meeting. Sincerely,

HENRY A. FERNANDEZ Chairman, Chief Executive Officer and Shareholder |

| 4 | MSCI |

Letter from our Independent

Lead Director

The Board’s role is critical in overseeing MSCI’s strategy, and we continue to work closely with management on matters regarding the business, its performance and its long-term outlook. | Dear fellow shareholders, | ||

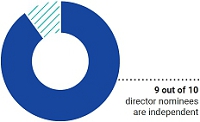

The independent directors of MSCI and I join Henry in inviting you to attend our Company’s 2022 Annual Meeting. It is a privilege to continue serving as your independent Lead Director during this important time for MSCI. As we approach the 2022 Annual Meeting, I am grateful for this opportunity to share with you some of the ways that the Board has worked together over the past year to provide independent oversight of areas that are important to you. Shareholder Engagement As a Board, we actively engage with our shareholders and gain firsthand information on the areas that matter most to them, including not just strategy and financial performance, but other key issues such as corporate responsibility, our efforts around diversity, equity and inclusion (“DE&I”), executive compensation and corporate governance. In the winter of 2021, during our Corporate Responsibility Roadshow, members of MSCI’s senior management engaged with top shareholders representing more than 40% of our shares outstanding. Members of the Governance and Corporate Responsibility Committee of the Board, Jacques Perold and Paula Volent, participated in discussions with several shareholders during these meetings. As detailed in this Proxy Statement, under “Shareholder Engagement,” we covered a range of topics, and the Board continues to use your input to inform our practices to ensure they align with shareholder interests. We welcome your continued engagement and feedback. Board Composition and Process An essential component of the Board leadership structure at MSCI is oversight by independent directors. As MSCI’s Lead Director, I am responsible for helping ensure that the Board exercises its role independent from the management | of the Company, as described in this Proxy Statement, under “Structure of our Board,” to ensure independent and effective oversight. One of my priorities as Lead Director is to ensure the Board is comprised of directors who are equipped to oversee the risks and opportunities of this business. This year’s Board nominees represent a wide range of backgrounds and expertise. We believe our diversity of experiences, perspectives and skills contribute to the Board’s effectiveness in managing risk and providing guidance to position MSCI for long-term success across rapidly changing business environments for us and for our clients. Of the 10 Board nominees, 9 are independent, which includes all committee chairs and members. We are pleased to announce the nomination of Rajat Taneja for election to the Board at our 2022 Annual Meeting. Rajat is President of Technology for Visa Inc., and has 30 years of global technology, innovation, and research and development experience. He has been a tremendous addition to the Board as we seek to increasingly leverage cutting-edge technologies to deliver enhanced user experiences and evolve MSCI’s cybersecurity program. Rajat’s appointment in 2021 was informed by the Board’s continued focus on its composition, as well as insights provided through the Board’s annual evaluation process, which includes both evaluation of the Board and its Committees as well as individual director evaluation through interviews that I conduct with each director. We also consistently prioritize a focus on the Board’s processes and structures to ensure they remain effective. In 2021, we instituted a review of the roles and responsibilities of our committees. We enhanced our committee charters to reflect leading practices and renamed |

| 2022 PROXY STATEMENT | 5 |

the Audit and Risk Committee; Compensation, Talent and Culture Committee; and Governance and Corporate Responsibility Committee to provide more clarity and transparency to stakeholders on areas of Board committee-level oversight. These changes in committee names and scope reflect the strategic significance that risk oversight, talent and culture management and corporate responsibility have to our long-term success, and they reflect the growing focus of these areas by our shareholders and the broader stakeholder community. Commitment to Corporate Responsibility The Board and its Governance and Corporate Responsibility Committee are actively engaged in overseeing MSCI’s corporate responsibility efforts, including to ensure that our practices complement our leadership in ESG and climate. Based on feedback from you, in 2021, we announced our net-zero commitment and increased the amount of reporting we prepare relating to our corporate responsibility efforts, including our first United Nations Sustainable Development Goals (SDG) report and our first Sustainable Finance Disclosure Regulations (SFDR) report. In addition, we published our two most recent EEO-1 reports (containing demographic data for our U.S. employees by race/ethnicity, gender and job categories) as well as SASB-aligned diversity disclosure, and we have committed to doing so in the future. As you will see in this Proxy Statement, we have added a more detailed “Corporate Responsibility” section to provide transparency on the governance of our corporate responsibility efforts by the Board and management. Our People and the Future of Work We are committed to ensuring that MSCI’s programs related to our employees continue to support our people and our strategy during a period of rapid change. The Board fully appreciates that MSCI’s employees are an essential element of our long-term success, and we spent significant time in 2021 reviewing the Company’s approach to organizational development, talent development, DE&I initiatives and succession planning. In particular, we focused on flexibility in how and where our employees work, and in January 2022, we implemented our “Future of Work,” a hybrid work environment that utilizes pandemic lessons to allow our employees to work at times at the office and other times remotely, depending on the requirements of specific roles. Following an extensive organizational design assessment, we also announced several changes to senior management, as well as the expansion of | MSCI’s Executive Committee to include greater representation from key operating functions, in particular, Research, Technology and Data, and Private Assets. In 2021, we also spent significant time reviewing the Company’s executive compensation program to ensure that MSCI is appropriately incentivizing long-term performance and shareholder value creation. Over the past several years, MSCI has chosen to incorporate a number of performance-based metrics and qualitative goals to reward exceptional performance, including by assessing performance against individualized DE&I goals, which are directly linked to a portion of each Managing Director’s annual incentive compensation. As we continue to promote an “owner-operator” mindset within the Company, we also significantly enhanced the stock ownership requirements applicable to our senior leaders. You can learn more about our executive compensation program in this Proxy Statement, under “Compensation Matters.” Oversight of Strategy and Risk The Board’s role is critical in overseeing MSCI’s strategy, and we continue to work closely with management on matters regarding the business, its performance and its long-term outlook. The Board sees an incredible opportunity for MSCI to continue to be a leader in the evolving global investment landscape, and, in 2021, our Board meetings regularly included consideration of significant business and organizational initiatives, capital allocation strategies and corporate development opportunities, including our acquisition of Real Capital Analytics in September. Throughout the year, the Board was also kept informed of enterprise risk and information technology risk developments, including our technology infrastructure, regulatory and compliance matters, public policy developments, risks and opportunities related to climate and go-to-market strategy. On behalf of my fellow independent directors and the entire Board, thank you for your continued support. We appreciate the opportunity to serve MSCI on your behalf in 2022 and beyond. We look forward to hearing your views at the 2022 Annual Meeting and through our on-going engagement. Sincerely,

ROBERT G. ASHE Independent Lead Director and Shareholder |

| 6 | MSCI |

Notice of Annual Meeting

of Shareholders

Annual Meeting Proposals and Voting Recommendations

| 1 | Election of Directors | “FOR” each nominee  SEE PAGE 20 SEE PAGE 20 | ||||||||

| ||||||||||

| ||||||||||

| 2 | Advisory Vote to Approve Executive Compensation (Say-on-Pay) | “FOR” SEE PAGE 55 SEE PAGE 55 | ||||||||

| Ratification of the

| “FOR” SEE PAGE 99 SEE PAGE 99 | ||||||||

Fellow Shareholder:

I cordially invite you to attend MSCI Inc.’s 2018The virtual annual meeting of shareholders (the “2018 Annual Meeting”) to be held via the internet through a virtual web conference atwww.virtualshareholdermeeting.com/MSCI2018 on May 10, 2018will commence at 2:30 P.M., Eastern Time, and any adjournments or postponements thereof,Time. Online check-in will be available beginning at 1:30 P.M., Eastern Time. Please allow ample time for the following purposes:online check-in process.

Our Board of Directors recommends thatTo participate in the virtual annual meeting, you vote “FOR”will need the election of the directors, the approval,16-digit control number included on an advisory basis, of our executive compensation and the ratification of the appointment of our independent auditor.

We are once again pleased to take advantage of the Securities and Exchange Commission (“SEC”) rules that allow us to furnish our proxy materials over the internet. As a result, we are mailing to many of our shareholders theyour Notice of Internet Availability of Proxy Materials, instead of a paper copy of ouron your proxy materials, including thiscard or on any additional voting instructions that accompanied your proxy statement (the “Proxy Statement”) and our annual report on Form10-K for the year ended December 31, 2017 (the “2017 Annual Report onForm 10-K”). The Notice of Internet Availability of Proxy Materials contains instructions on how to access this Proxy Statement (including the proxy card) and our 2017 Annual Report on Form10-K over the internet, how to request a paper or email copy of these materials and how to vote by mail or via the internet. We believe that posting the proxy materials on the internet expedites shareholders’ receiptmaterials.

A webcast replay of the information that they need, while lowering our costs of printing and delivery and reducing the environmental impact of our2022 annual meeting of shareholders.shareholders (the “2022 Annual Meeting”) will also be made available on our Investor Relations website (https://ir.msci.com).

Our Board of Directors has fixed the close of business on March 14, 2018 as the record date for determining the shareholders entitled to notice of, andIf you are a beneficial shareholder, your broker will not be able to vote at, our 2018 Annual Meeting. The Notice of Internet Availability of Proxy Materials will be mailed to our shareholders of record beginning on or about March 23, 2018. These proxy materials are being made available beginning on or about March 23, 2018.

As a shareholder of MSCI Inc., your vote is important. Whether or not you plan to attend our 2018 Annual Meeting, it is important that you vote as soon as possible to ensure that your shares are represented. For information on howwith respect to vote by mail, telephone, or viaany of the internet, please refer tomatters presented at the question “How do I vote my shares?” in Annex A,meeting, other than the Proxy Statement Summary,ratification of the proxy card, or the Noticeselection of Internet Availability of Proxy Materials distributed toour independent registered public accounting firm, unless you on or about March 23, 2018.give your broker specific voting instructions.

Thank you for your support of MSCI Inc.

|

|

|

|

Important Notice Regarding the Availability of Proxy Materials for the

December 31, is not incorporated by reference into this Proxy Statement or any other report we file with the SEC. |

| DATE AND TIME APRIL 26, 2022 (Tuesday) 2:30 P.M., EASTERN TIME |

| LOCATION Attend the virtual meeting, including to vote and/or submit questions via the internet through a virtual web conference at: www.virtualshareholder |

| RECORD DATE MARCH 1, 2022 |

MSCI INC.2018 PROXY STATEMENT iHow to Vote

Whether or not you plan to attend our 2022 Annual Meeting, it is important that you vote as soon as possible to ensure that your shares are represented.

| INTERNET www.proxyvote.com Use the internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time on April 25, 2022. Have your proxy card in hand when you access the website and follow the instructions to obtain your records and to create an electronic voting instruction form. |

| TELEPHONE 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time on April 25, 2022. Have your proxy card in hand when you call and then follow the instructions. |

| Mark, sign and date your proxy card and return it in the postage- paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. |

| 2022 PROXY STATEMENT | 7 |

NOTE ON FORWARD-LOOKING STATEMENTS This Proxy Statement contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements relate to future events or to future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these statements. In some cases, you can identify forward-looking statements by the use of words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or “continue,” or the negative of these terms or other comparable terminology. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties and other factors that are, in some cases, beyond our control and that could materially affect our actual results, levels of activity, performance or achievements. Other factors that could materially affect actual results, levels of activity, performance or achievements can be found in the 2021 Annual Report on Form 10-K filed with the SEC on February 11, 2022 and in quarterly reports on Form 10-Q and current reports on Form 8-K filed or furnished with the SEC. If any of these risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may vary significantly from what MSCI projected. Any forward-looking statement in this Proxy Statement reflects MSCI’s current views with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to MSCI’s operations, results of operations, growth strategy and liquidity. MSCI assumes no obligation to publicly update or revise these forward-looking statements for any reason, whether as a result of new information, future events or otherwise, except as required by law. Information and reports on our website or other websites that we refer to in this Proxy Statement will not be deemed a part of, or otherwise incorporated by reference in, this Proxy Statement or any other report we file with the SEC. |

| 8 | MSCI |

This summary highlights information contained elsewhere in this Proxy Statement. It does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting.

Annual Meeting Information

MSCI Inc. trades under the

| |||||

As of December 31, 2021, 4,303people and served over 6,300clients in more than 95 countries. We are a leading provider of critical decision support tools and solutions for the | |||||

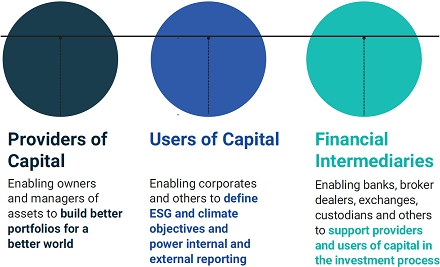

Mission To enable investors to build better portfolios for a better world. Strategic Pillars of Growth Extend leadership in research-enhanced content across asset Lead the Enhance distribution and content-enabling technology Expand solutions that empower client customization Strengthen client relationships and grow into strategic partnerships with clients Execute strategic relationships and acquisitions with complementary content and technology companies Addressing All Participants in the

| |||||

| ||

|

| |

|

| |

|

| |

During the virtual meeting, you will be able to vote electronically and submit questions atwww.virtualshareholdermeeting.com/MSCI2018. A webcast replay of the 2018 Annual Meeting will also be archived on our Investor Relations website, http://ir.msci.com/events.cfm, until May 10, 2019.

Annual Meeting Agenda and Voting Recommendations

| ||||||

| ||||||

|

|

MSCI INC.2018 PROXY STATEMENT 1

PROXY STATEMENT SUMMARY

About MSCI Inc.

MSCI Inc. (referred to herein as the “Company, “MSCI,” “we,” “our,” “us”) is a leading provider of indexes and portfolio construction and risk management tools and services for global investors. On November 15, 2017, we celebrated the 10-year anniversary of our initial public offering (“IPO”). On March 14, 2018, our shares closed at $154.43, reflecting a 758% increase from our $18 share price at our IPO. Although we were legally incorporated in Delaware in 1998, we trace our beginnings to the licensing by one of our founding partners, Capital Group International, of our first global equity indexes in 1969. As of March 14, 2018, we had a market capitalization of approximately $14 billion. Our growth is attributable to our ongoing innovation and diverse portfolio of mission-critical investment decision support tools, which comprises the “One MSCI” framework and includes the following: indexes; portfolio construction and risk management products and services; Environmental, Social and Governance (“ESG”) research and ratings; and real estate research, reporting and benchmarking offerings. MSCI’s research-derived intellectual property includes methodologies, models, derived data and algorithms (collectively, “content”), as well as applications and services, which help our clients manage their investment processes and address their investment, risk and regulatory challenges. We also offer services that help clients use our content and applications more effectively and operate more efficiently.

We operate as a client-centric company, and our clients use our offerings for their most important investment activities across multiple asset classes, including benchmarking, index-linked product creation, portfolio construction, performance measurement and attribution, risk management, as well as investor and regulatory reporting. In addition, our clients are increasingly integrating the new content developed across our company, such as factor and ESG data and indexes, into their investment processes.

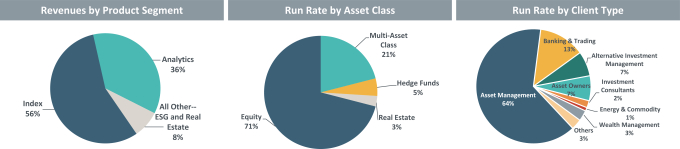

Our composition of revenue in 2017 and Run Rate(1) as of December 31, 2017 is as follows:

| ||||

Our Strategy

We aim to expand our position as a leading source for mission critical content, applications and services that support the investment processes of the largest and most sophisticated participants in the global investment industry. We have a comprehensive three-year strategic plan that is updated annually and is designed to further promote long-term shareholder value by: (1) creating broad, research-driven content, (2) expanding the client base and deepening existing client relationships, (3) developing flexible and scalable technology, (4) expanding value-added service offerings and (5) entering into strategic relationships and acquisitions.

In executing our strategy, we are committed to maintaining overall cost discipline and continuing to deliver positive operating leverage. Through disciplined expense management we can self-fund initiatives that deliver the highest return on investment. During 2017, our capital deployment strategy remained unchanged as we continued to prioritize returning capital to shareholders.

2 MSCI INC.2018 PROXY STATEMENT

PROXY STATEMENT SUMMARY

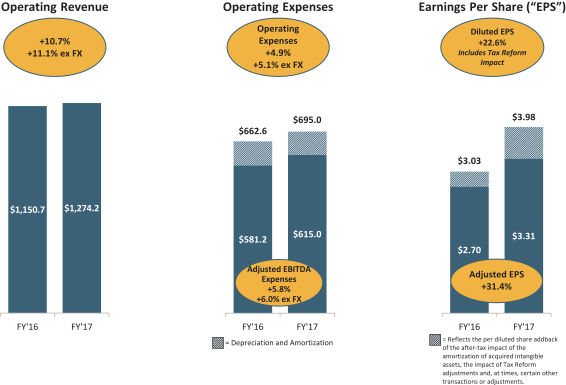

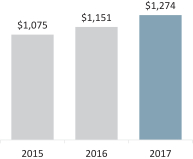

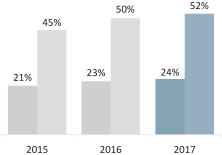

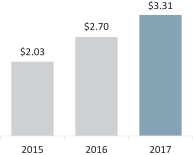

Strong Financial Performance

During 2017, our strong financial performance brought significant value to our shareholders in the form of substantial price appreciation and enabled us to continue investing in the long-term growth of the Company, as well as deliver on our commitment to returning capital to our shareholders in the form of share repurchases and dividends.

|

|

| ||||||

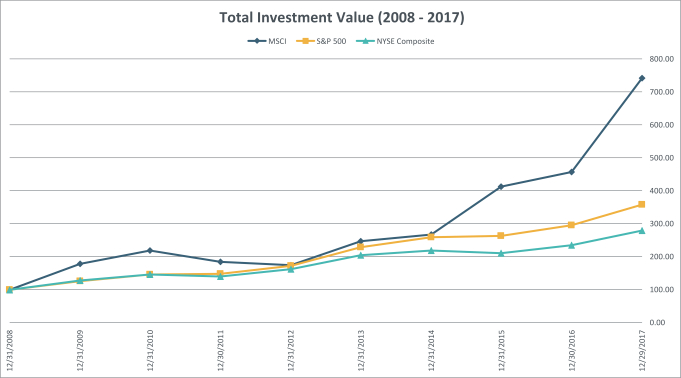

The following graph compares the cumulative total shareholders’ return (“TSR”) of our common stock, the Standard & Poor’s 500 Stock Index and the NYSE Composite Index since December 31, 2008 (a little over one year after our IPO) assuming an investment of $100 at the closing price of each respective investment on December 31, 2008. In calculating annual TSR, we have assumed the reinvestment of dividends, if any. The indexes are included for comparative purposes only. They do not necessarily reflect management’s opinion that such indexes are an appropriate measure of the relative performance of the common stock.

The above graph is not “soliciting material,” is not to be deemed filed with the SEC and is not to be incorporated by reference in any of our filings under the Securities Act of 1933 or the Securities Exchange Act of 1934 (the “Exchange Act”), as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

MSCI INC.2018 PROXY STATEMENT 3

PROXY STATEMENT SUMMARY

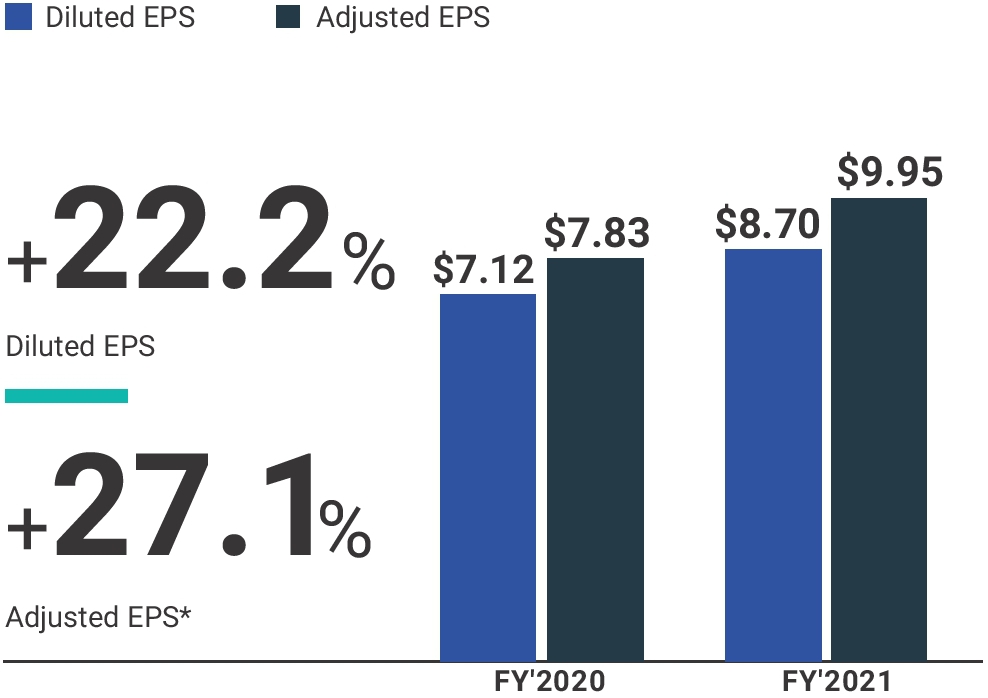

In 2017,2021, we continued to execute a focused strategy to accelerate growth, improve efficiency and attract the best talent. Our strong results reflect our commitment to building long-term shareholder value. Financial highlights for the year ended December 31, 20172021 include the following:

20172021 Financial Highlights(1)

(in millions except percentages) | OPERATING EXPENSES (in millions except percentages) | |

|  | |

| DILUTED EPS / ADJUSTED EPS* (unaudited) | CASH FROM OPERATING ACTIVITIES (in millions except percentages) | |

|  |

| * | MSCI has presented supplemental non-GAAP financial measures as part of this Proxy Statement. Definitions of each non-GAAP measure and a reconciliation of each non-GAAP financial measure with the most comparable GAAP measure are set forth inAnnex |

| 10 | MSCI | PROXY SUMMARY |

Aligning Executive Compensation with Company Strategy and Performance

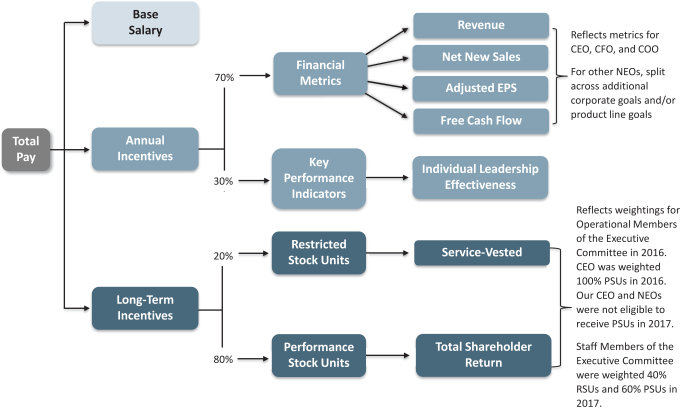

We believe our executive compensation program was integral to our successful financial performance in 2017. To align the interests and compensation of our named executive officers (“NEOs”) with the long-term interests of our shareholders and to further drive the performance culture that is a key to successfully delivering on our corporate strategy, MSCI’s executive compensation program emphasizes performance-based compensation in the form of equity grants under our Long-Term Incentive Plan (“LTIP”) and the payment of cash incentives under our Annual Incentive Plan (“AIP”). In February 2016, in conjunction with the implementation of our three-year strategic growth plan focused on One MSCI, client-centricity, capital optimization and operating efficiencies, we reformulated our executive compensation program to be one that is more closely aligned with shareholder interests and focused on the achievement of both short- and long-term financial and strategic targets, including an LTIP that incentivizes our executives to focus on the long-term execution of our strategic priorities to create shareholder value.

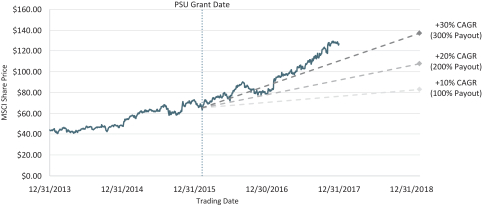

LTIP. In 2016, we granted multi-year performance stock units (“PSUs”) to each of our NEOs that cover a three-year performance cycle (“Multi-Year PSUs”) consisting of fiscal years 2016, 2017 and 2018. Because the Multi-Year PSUs operate on an end-to-end basis without overlapping cycles or additional grants of PSUs during the performance cycle, no additional PSUs were awarded to our NEOs in 2017, and none will be awarded in 2018. The Multi-Year PSUs will vest between 0% and 300% based on the achievement of a challenging multi-year absolute total shareholder return compound annual growth rate (“TSR

4 MSCI INC.2018 PROXY STATEMENT

PROXY STATEMENT SUMMARY

CAGR”) performance metric (or a multi-year relative TSR CAGR (“Relative TSR CAGR”) performance metric applicable in certain circumstances as further described on page 53 of this Proxy Statement).

Our NEOs, other than our CEO, continue to receive annual grants of restricted stock units (“RSUs”). Mr. Fernandez’s LTIP award is granted entirely in the form of PSUs and, as such, he did not receive any additional equity awards in 2016 and 2017, and he will not be granted any equity awards in 2018. The awards granted under the LTIP in 2017 for each of our NEOs are further detailed in the Summary Compensation Table for 2017 on page 58. See the table on page 40 of this Proxy Statement, which reflects the annualized portion of the target value of the Multi-Year PSUs attributable to 2017 (i.e., one-third of the total target value of the Multi-Year PSUs).

AIP. The AIP closely aligns the interests of our NEOs with those of shareholders by using a formulaic approach based on specific annual financial criteria and individual key performance indicators (“KPIs”) when determining annual cash incentives. The Compensation & Talent Management Committee (the “Compensation Committee”) regularly assesses the metrics and weighting of those metrics, in addition to shareholder feedback, to ensure that the AIP reflects the appropriate metrics and proper balance of those metrics necessary to deliver the annual growth that will serve as the foundation for longer-term value creation. In 2018, in response to shareholder feedback, the Compensation Committee expanded the inclusion of Adjusted EPS to the product-level grids, rather than only including it in the corporate-level grid, because Adjusted EPS is a primary measure used by many of our shareholders in assessing our ongoing performance.Capital Allocation Program

Since our 2017 Say-on-Pay vote, the Compensation Committee’s actions with respect to our CEO’s compensation were solely to (i) increase his annual base salary (effective January 1, 2018) from $950,000 to $1,000,000 to align with competitive market practice (the first increase in Mr. Fernandez’s base salary since 2014), (ii) pay Mr. Fernandez an annual cash bonus in respect of 2017 of approximately $1.5 million under our AIP, based on actual performance against the applicable financial metrics and his KPIs and (iii) increase his fiscal 2018 target cash incentive to $1.4 million to be paid under the AIP to reflect competitive market practice. As reflected in the table on page 41 of this Proxy Statement, on an annualized basis, Mr. Fernandez’s 2017 compensation (which is the subject of this year’s Say-on-Pay vote) increased by only 1.4% relative to 2016.

Actual cash incentives paid to our NEOs for 2017 were higher than their target values based on actual performance against the applicable financial metrics and their KPIs due to our strong financial performance and the performance of our NEOs in 2017. See the table on page 52 of this Proxy Statement for the actual amounts paid.

Shareholder Engagement. Before, during and following the 2017 proxy season, we engaged with the governance and/or proxy voting groups of 19 of our institutional shareholders, representing a majority of our outstanding common shares, to discuss corporate governance and executive compensation related matters. Members of our investor relations, executive compensation and corporate governance groups participated in these meetings, and for certain meetings, one of our independent directors was present to answer questions, including our Compensation Committee Chair or our Lead Director. Most of the shareholders with whom we engaged were generally supportive of our current LTIP and its alignment of pay with performance, although certain shareholders had different views as to their preferred performance metrics and the appropriate performance period. Some of the topics which we discussed and received feedback from our shareholders on included certain features of our LTIP (including the Multi-Year PSUs), including:

The feedback we received from shareholders was reported to the Compensation Committee and the full Board. Because we granted the Multi-Year PSUs in 2016, we have and will continue to honor our commitment to our shareholders not to grant our NEOs any PSUs in 2017 or 2018. However, we will not be in a position to incorporate feedback we received from our shareholders until we design our 2019 LTIP awards, at which time we will take into account the feedback from our shareholders as we consider that design.

MSCI INC.2018 PROXY STATEMENT 5

PROXY STATEMENT SUMMARY

The Company will continue to maintain an active dialogue with shareholders and evaluate feedback on issues of importance to them, including the metrics that drive each of our NEO’s long-term incentive compensation. Our engagement with shareholders on executive compensation is further described on page 44 of this Proxy Statement.

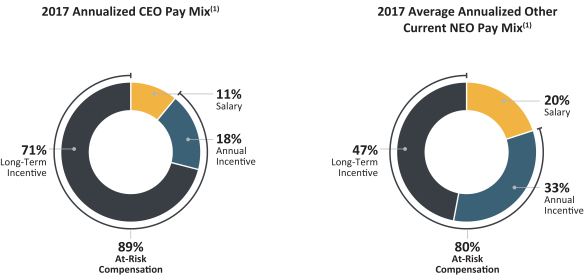

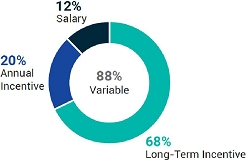

Primary Components of 2017 Target Compensation

As reflected in the below pay mix charts, our executive compensation program is designed to pay base salaries to our NEOs that represent a relatively small percentage of their total compensation, while offering them the opportunity to earn a significant portion of their compensation in the form of variable compensation (i.e., annual cash bonuses and long-term incentive awards).

| ~$3.1 billion Capital returned in the five years (as of December 31, 2021) (includes dividends) | ~11.3 million Shares repurchased in the last five years (as of December 31, 2021) | ~33.3 percent 2021 increase in quarterly per-share dividend from $0.78 quarterly to |

For additional detail on our executive compensation program, see our Compensation Discussion and Analysis beginning on page 37.

6 MSCI INC.2018 PROXY STATEMENT

$1.04 quarterly

PROXY STATEMENT SUMMARY

Environmental, Social and Governance Highlights

ESG considerations are becoming increasingly important to our shareholders and clients, as demonstrated by the growth in MSCI ESG Research and Ratings and MSCI ESG indexes. We also view strong ESG practices as core to our own success. What follows are some brief highlights of how we approach these issues at MSCI.

ANNUALIZED DIVIDEND RATES

| (1) | MSCI began paying quarterly dividends in September 2014 at an annualized rate of $0.72 per share. |

Capital Optimization Activities in 2021

| Increased regular quarterly cash dividend by approximately 33.3% to $1.04 per share, representing $4.16 per share on an annualized basis. | |

| ● | Repurchased over 300,000 shares of our common stock at an average price of $412.25 per share for a total value of $140 million. |

| ● | Issued $500 million of 3.625% senior unsecured notes due 2030; leveraged lower coupon rate for pre-maturity redemption of $500 million of 4.750% senior unsecured notes due 2026. |

| ● | Issued $600 million of 3.625% senior unsecured notes due 2031. |

| ● | Issued $700 million of 3.250% senior unsecured notes due 2033; leveraged lower coupon rate for pre-maturity redemption of $500 million of 5.375% senior unsecured notes due 2027. |

| 2022 PROXY STATEMENT | 11 |

Total Shareholder Return

The following graph compares the cumulative total shareholders’ return (“TSR”) of our common stock, the Standard & Poor’s 500 Stock Index and the NYSE Composite Index since December 31, 2011 assuming an investment of $100 at the closing price of each respective investment on December 31, 2011. In calculating annual TSR, we have assumed the reinvestment of dividends, if any. The indexes are included for comparative purposes only. They do not necessarily reflect management’s opinion that such indexes are an appropriate measure of the relative performance of our common stock.

COMPARISON OF CUMULATIVE TEN YEAR TOTAL RETURN

The above graph is not “soliciting material,” is not to be deemed filed with the SEC and is not to be incorporated by reference in any of our filings under the Securities Act of 1933 or the Securities Exchange Act of 1934, as amended (the “Exchange Act”), whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

| Company Name/Index | 12/31/11 | 12/31/12 | 12/31/13 | 12/31/14 | 12/31/15 | 12/31/16 | 12/31/17 | 12/31/18 | 12/31/19 | 12/31/20 | 12/31/21 | ||||||||||||||

| MSCI Inc. | $100.00 | $ | 94.11 | $132.77 | $144.65 | $222.77 | $246.44 | $400.77 | $472.71 | $837.61 | $ | 1,460.66 | $ | 2,017.74 | |||||||||||

| S&P 500 Index | $100.00 | $ | 116.00 | $153.57 | $174.60 | $177.01 | $198.18 | $241.45 | $230.86 | $303.56 | $ | 359.41 | $ | 462.57 | |||||||||||

| NYSE Composite Index | $100.00 | $ | 116.03 | $146.52 | $156.41 | $150.02 | $167.92 | $199.37 | $181.53 | $227.84 | $ | 243.76 | $ | 294.16 | |||||||||||

Source: S&P Global

| 12 | MSCI | PROXY SUMMARY |

Corporate Responsibility

We believe, and our research shows, that sound ESG and climate practices are commonly linked to better business results. We provide the global financial community with innovative products and services that enable investors to make better investment decisions for a better world. As a leader in providing ESG and climate solutions to investors, we also aim to demonstrate leading corporate responsibility practices.

Our commitment to corporate responsibility is embodied in the following four pillars:

| |||||||

|

|

| |||||

● ESG and Climate Research ● Published “The Role of Capital in the Net-Zero Revolution” to identify specific steps to drive to a net-zero economy by 2050 ● Published the “Women on Boards Progress Report,” our annual survey on the state of women’s representation on corporate boards ● Published “Breaking Down Corporate Net-Zero Climate Targets” to provide a framework to assess companies’ decarbonization targets ● Data and Metrics Published ● Launched our Implied Temperature Rise search tool, which discloses how individual companies align with different climate pathways and decarbonization targets ● Launched the MSCI Net-Zero Tracker to gauge progress by the world’s public companies toward curbing climate risk ● Released the U.S. Racial and Ethnic Data Set to provide information on select U.S. companies’ disclosure practices and policies with regards to racial and ethnic diversity | ● Product Launches and Initiatives ● Launched our MSCI Climate Lab Enterprise product to help investors monitor and manage climate risk across the investment process ● Expanded our toolkit of climate data and reporting capabilities to help investors meet the requirements of the E.U. Sustainable Finance Disclosure Regulation (“SFDR”) ● Together with The Burgiss Group, LLC (“Burgiss”), launched the Carbon Footprinting of Private Equity and Debt Funds product to measure the carbon intensity of private assets ● ESG and Climate Index Launches ● Introduced MSCI Climate Paris Aligned Indexes, designed to support investors seeking to reduce their exposure to transition and physical climate risks ● Launched a new suite of Circular Economy Indexes that aim to represent the performance of companies that facilitate a transition to a circular economy, addressing global resource challenges such as energy scarcity, biodiversity loss, waste and pollution |

|

| ||||

MSCI INC.2018 PROXY STATEMENT 7

PROXY STATEMENT SUMMARY

ESG Highlights (Continued)

|

| |||

Build a highly engaged workforce, including through learning and | |||||

● Diversity Equity & Inclusion (DE&I) ● Hired our first Chief Diversity Officer, responsible for operating across MSCI to align our DE&I goals with business outcomes, help embed DE&I considerations in the way we do business, attract and retain the best diverse talent and increase the impact of our internal workplace initiatives ● Published our 2020 and 2019 U.S. Consolidated EEO- 1 Report data, in addition to disclosing diversity data aligned to Sustainability Accounting Standards Board (“SASB”) categories ● Formed three new DE&I employee resource groups (“ERGs”), the Asian Support Network, All Abilities Network and Hola! MSCI ● Executed 4th Annual | ● Compensation ● All Managing Directors created, and were held accountable for, individual DE&I Goals directly linked to their 2021 compensation ● Enhanced Executive Committee Share Ownership Guidelines to be one of ● Employee Engagement: In our most recent employee engagement survey (not including employees from newly acquired companies), the percentage of respondents characterized as “fully engaged” equaled the highest since implementing the survey ● Future of Work: Launched our Future of Work initiative that introduces increased flexibility of when and where employees work, reimagines the use of our offices and ramps up the use of technology to enhance our interactions with

|

| |||

|

| ||||

|

| |||

|

|

|

8 MSCI INC.2018 PROXY STATEMENT

Sustainable Operations Manage carbon emissions and climate risks, and implement sustainable operational practices | ||||

RECENT HIGHLIGHTS ● New Commitments ● Committed to a goal of net-zero carbon emissions before 2040 throughout our operations, prioritizing reducing our most material and controllable emissions and engaging with our suppliers ● Committed to support all of the United Nations (“UN”) Sustainability Development Goals (“SDGs”) and aim to measure impact for SDGs relating to gender equality, decent work and economic growth, reduced inequality and climate action ● External Recognition: Improved our CDP score to reach leadership score of A- ● Expanding Alliances ● Became a founding member of the Net Zero Financial Service Providers Alliance, committing to align our relevant services and products with a 2050 net-zero emissions target ● Participated in, and met with policymakers and financial regulators at, the UN Climate Change Conference (COP26) | ● Engaging with our Suppliers ● Updated Supplier Code of Conduct to address emissions in the MSCI supply chain. Prioritized engagement with major suppliers to align net-zero goals ● Developed an internal Sustainable Supplier Management Team to support efforts to learn about our suppliers’ corporate responsibility practices and seek alignment with our own commitments ● New Reporting ● Published first SFDR report ● Published first UN SDGs report ● Updating our Policies ● Updated our Environmental Policy to include our commitment to net-zero and to environmental issues (e.g., biodiversity, waste and water) ● Updated our Travel Policy to encourage employees to prioritize virtual meetings and use of low carbon travel options | |||

Robust Governance Implement policies and practices that reflect MSCI’s commitment to strong governance practices | ||||

RECENT HIGHLIGHTS ● Board Developments ● Appointed Rajat Taneja, a new director with a deep background in technology ● Enhanced Board Committee Charters to reflect leading practices and renamed the Audit and Risk Committee, Compensation, Talent and Culture Committee and Governance and Corporate Responsibility Committee to provide more clarity and transparency on Board committee-level oversight ● Conducted board education sessions to strengthen the Board’s expertise on climate, including sessions on climate science, climate investing, climate reporting solutions and net-zero commitments | ● Corporate Responsibility Governance ● Formed a Corporate Responsibility Policy Committee (“CRPC”), responsible for reviewing strategic corporate responsibility initiatives ● Expanded the Corporate Responsibility Committee (“CRC”) to include new members from DE&I, Technology, Data Management, Client Coverage, Controllership and Financial Planning & Analysis teams. ● Risk Oversight: Integrated climate and DE&I into our risk management program, with reporting to the Audit and Risk Committee | |||

For additional information about our Corporate Responsibility Program, please see page 45 of this Proxy Statement.

| 14 | MSCI | PROXY |

Governance Highlights

Our Board of Directors Nominees

Each of our current directors except Patrick Tierney who is retiring from our Board, effective May 1, 2018, and Rodolphe M. Vallee who is retiring from our Board, effective May 10, 2018, is standing for election to hold office until the next annual meeting of shareholders or until the director’s earlier resignation, death or removal. The table below provides information on each of our director nominees.nominees, including which of our four standing committees the director nominee sits on. Our four standing committees are the Audit and Risk Committee (the “Audit Committee”), the Compensation, Talent and Culture Committee (the “Compensation Committee”), the Governance and Corporate Responsibility Committee (the “Governance Committee”) and the Strategy and Finance Committee (the “Strategy Committee”).

Name | Age | Director Since | Principal Occupation | Independent | ||||

Henry A. Fernandez | 59 | 2007 | Chairman and CEO, MSCI Inc. | |||||

Robert G. Ashe | 59 | 2013 | Former General Manager, Business Analytics, IBM Corp. (Formerly CEO of Cognos Inc.) | ✔ | ||||

Benjamin F. duPont | 54 | 2008 | Co-Founder and Partner, Chartline Capital Partners | ✔ | ||||

Wayne Edmunds | 62 | 2015 | Interim Group CEO, BBA Aviation | ✔ | ||||

Alice W. Handy | 69 | 2009 | Managing Member, Investure | ✔ | ||||

Catherine R. Kinney | 66 | 2009 | Former President, New York Stock Exchange | ✔ | ||||

Wendy E. Lane | 66 | 2015 | Chairman, Lane Holdings, Inc. | ✔ | ||||

Jacques P. Perold | 59 | 2017 | Former President, Fidelity Management and Research Company | ✔ | ||||

Linda H. Riefler | 57 | 2007 | Former Chairman of Global Research and Chief Talent Officer, Morgan Stanley | ✔ | ||||

George W. Siguler | 70 | 2009 | Co-Founder, Siguler Guff & Company | ✔ | ||||

Marcus L. Smith | 51 | 2017 | Former Director of Equity (Canada) and Portfolio Manager, MFS Investment Management | ✔ |

Our 11 director nominees have had senior leadership experience at various domestic and multinational companies. In these positions, they obtained diverse skills that are valuable for the execution

| 2022 PROXY STATEMENT | 15 |

Director Core Competencies

Proposal 1

Election of Directors | The Board recommends a vote FOR each director nominee.

|

| 16 | MSCI | PROXY SUMMARY |

Engaging with our Shareholders

We believe that engaging with our shareholders, prospective shareholders and sell-side analysts is the best way to address the issues that matter most to them. During 2021, we held over 300 meetings covering a wide range of matters. While we aim to engage with our shareholders year-round through investor meetings and industry conferences, our key shareholder engagement activities for 2021 included our Investor Day held in February 2021 and our Corporate Responsibility Roadshow conducted in the winter of 2021.

Shareholder Outreach Team | Senior Business Leaders | + | Finance and Investor Relations Team | + | Corporate Secretary Team | + | Human Resources Team, including Chief Diversity Officer | + | Corporate Responsibility Team and Global Corporate Services Team | + | Members (select meetings) | |||||||||||||||

| What We Discussed | OUR BUSINESS Market Trends Competitive Environment Product Development Financial Performance Overall Outlook | OUR CORPORATE RESPONSIBILITY EFFORTS Corporate Responsibility Practices and Disclosures, including ESG & Climate Human Capital Management, Executive Compensation Program | OVER 300 meetings with our shareholders, prospective shareholders and sell-side analysts, including successful Investor Day and Corporate Responsibility Roadshow ~58% of our shares outstanding represented across our shareholder engagement meetings in 2021 |

See “Shareholder Engagement” on page 40 for more information on our year-round shareholder engagement activities.

| 2022 PROXY STATEMENT | 17 |

Proposal 2 Advisory Vote to Approve Executive Compensation (Say-on-Pay) | The Board recommends a vote FOR this proposal.

|

Aligning Executive Compensation with Company Strategy, Culture and Performance

We believe our executive compensation program was integral to our successful financial performance in 2021. Our executive compensation program is designed not only to closely align the compensation and interests of our named executive officers (“NEOs”) with the long-term interests of our shareholders, but also to reflect the economic realities of our operating environment. MSCI’s executive compensation program emphasizes performance-based compensation in the form of cash incentive awards under our Annual Incentive Plan (“AIP”) and equity incentive awards under our Long-Term Incentive Plan (“LTIP”) that focus respectively on the achievement of short- and long-term financial and strategic targets.

| SHORT-TERM (ANNUAL INCENTIVE PLAN CASH BONUS) | LONG-TERM (EQUITY GRANTS) | |||||||

| ● Restricted Stock Units (for 2021, ratable vest, and for 2022, cliff-vest after a three-year service period) ● Performance Stock Units (earned based on absolute TSR CAGR) with a 1-year post vesting mandatory holding period for 3-Year PSUs ● Performance Stock Options (earned based on cumulative revenue and cumulative Adjusted EPS) (new for 2022) | |||||||

| 2021 ANNUALIZED CEO | 2021 AVERAGE ANNUALIZED OTHER NEOS |

|  |

In 2021, our CEO received over 90% of his compensation in the form of “at-risk” variable compensation under the AIP and LTIP (on average, over 85% in the case of our other NEOs).

Annual Incentive Plan

The AIP closely aligns the interests of our NEOs with those of our shareholders by emphasizing a formulaic approach to determine annual cash incentive awards, which are based on the achievement of specified annual financial criteria aligned with our Board-approved Operating Plan (70% of the target annual cash bonus under the AIP), individual key performance indicators (“KPIs”) (20% of the target annual cash bonus under the AIP) and specific DE&I goals (“DE&I Goals”) (10% of the target annual cash bonus under the AIP) that serve to focus our senior management team on enhancing DE&I progress within the Company. The Compensation Committee regularly assesses the components and metrics used in the AIP and the weighting of those components and metrics, in addition to taking into account shareholder feedback.

For additional information about the 2021 AIP program, please see the discussion on page 71 of this Proxy Statement.

| 18 | MSCI | PROXY SUMMARY |

Long-Term Incentive Plan

The LTIP is designed to prioritize shareholder value creation and facilitate an “owner-operator” mindset among our senior executives.

In 2021, we granted our NEOs a mix of RSUs and PSUs (including separate awards of PSUs with a 3-year cumulative performance period (“3-Year PSUs”) and PSUs with a 5-year cumulative performance period (“5-Year PSUs”)), the mix of which varies based on the executive’s position. Consistent with our recent practice, each of our CEO and President & COO received 100% of his equity incentive compensation in 2021 in the form of PSUs. In addition, for 2021, the Compensation Committee increased the proportion of our President & COO’s 5-Year PSUs from 50% to 60% of his overall equity incentive compensation (with the remaining 40% granted in the form of 3-Year PSUs), commensurate with our CEO.

In 2022, the Compensation Committee enhanced our LTIP by introducing a new award vehicle into the program: financial-based performance stock options (“PSOs”) that cover a cumulative three-year performance period and replace the grant of 5-Year PSUs.

The 2022 LTIP comprises a mix of the following:

RSUs | Annual grant of RSUs to our NEOs (other than our CEO and President & COO) that cliff-vest at the end of a three-year service period. This reflects a change from ratable vesting over three years for RSUs granted prior to 2022. ●Our CEO and President & COO were not granted any RSUs in 2021 or 2022, and instead all of their LTIP awards for such years were granted in the form of PSUs and PSOs tied to performance metrics. | |

| 2022 PSUs | Annual grant of PSUs which cover a cumulative three-year performance period. The 3-Year PSUs are eligible to vest between 0% and 300% based on the achievement of an absolute total shareholder return compound annual growth rate (“TSR CAGR”) performance metric. The 3-Year PSUs include a one-year post-vest mandatory holding period. | |

| 2022 PSOs | Annual grant of PSOs which cover a cumulative three-year performance period. The PSOs are eligible to vest between 0% and 200% based on the combined level of achievement of (i) a cumulative revenue performance goal and (ii) a cumulative adjusted EPS performance goal (each weighted at 50%). |

For additional information about the LTIP, please see the discussion beginning on page 79 of this Proxy Statement.

Increased Stock Ownership and Retention Requirements

In 2022, in order to further enhance an “owner-operator” mindset among senior executives, our Compensation Committee amended our existing share ownership and retention guidelines to require that all members of our Executive Committee, including our NEOs, must hold shares equivalent, in the aggregate, to 25% of the “net shares” they receive (i.e., after payment of taxes, exercise price and related costs) from equity awards granted to them after January 1, 2022. The Compensation Committee also approved revisions to the minimum ownership guidelines to increase the thresholds applicable to members of our Executive Committee, including our NEOs, to among the highest in our peer group (including 12x base salary for our CEO and President & COO). For additional information about our Share Ownership and Retention Guidelines applicable to our NEOs, please see page 83 of this Proxy Statement.

| 2022 PROXY STATEMENT | 19 |

Executive Compensation Highlights

Over the past several years, we have continued to enhance our executive compensation program to align with shareholder interests more closely and to further incentivize our executives to focus on the long-term execution of our strategic priorities to create shareholder value. The table below highlights certain key elements of, and enhancements to, our executive compensation program over the past several years.

| 2020 | 2021 | 2022 |

| | |

● No changes made to 2020 Operating Plan or annual cash incentive targets for 2020 under AIP in response to challenging operating environment ● 97.8% of the votes cast on the Say-on-Pay Advisory Vote at the 2020 annual meeting of shareholders were in support of the compensation of our NEOs ● No increase to CEO base salary or total target cash incentive award for 2020 ● CEO received all of his LTIP awards in the form of PSUs, and increased proportion of his 5-Year PSUs from 50% to 60% of total CEO equity compensation for 2020 ● President & COO began receiving all of his LTIP awards in the form of PSUs | ● CEO and President & COO received all of their LTIP awards in the form of PSUs ● Added a 1-year post-vest mandatory holding period to 3-Year PSU awards ● 96.8% of the votes cast on the Say-on-Pay Advisory Vote at the 2021 annual meeting of shareholders were in support of the compensation of our NEOs ● No increase to CEO and President & COO base salaries, total target cash incentive awards or target LTIP awards for 2021 ● President & COO increased proportion of 5-Year PSUs from 50% to 60% (commensurate with CEO) ● Linked 10% of the target AIP cash incentive for all Managing Directors globally to achievement of DE&I Goals | ● Introduced PSOs as new equity vehicle ● CEO and President & COO received all of their LTIP awards in the form of 3-Year PSUs and PSOs, tied to performance metrics ● Annual grant of RSUs for other NEOs will cliff-vest at the end of a three-year service period ● Retained 1-year post-vest mandatory holding period on 3-Year PSU awards ● Increased minimum share ownership requirements applicable to all members of our Executive Committee, including our CEO and President & COO to 12X base salary ● Added requirement that while members of the Executive Committee, such individuals including our NEOs, must hold shares equivalent, in the aggregate, to 25% of the “net shares” they receive from equity awards granted to them after January 1, 2022 ● No increase to CEO and President & COO base salaries or total target cash incentive awards for 2022 ● All Executive Committee members included a climate commitment goal in their 2022 individual KPIs under the AIP |

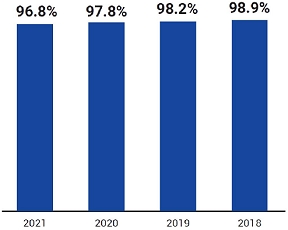

Response to Say-on-Pay Vote At our 2021 annual meeting of shareholders, stockholders again expressed overwhelming support for the compensation of our NEOs with approximately 96.8% of the votes cast approving our “Say on Pay” advisory proposal relating to our NEO compensation. This represents the fourth consecutive year of “Say on Pay” approval of 96% or higher. |  |

To read more about what our shareholders think of our Executive Compensation program, see the discussion on page 67 of this Proxy Statement.

Proposal 3 Ratification of the Appointment of MSCI’s Independent Auditor | The Board recommends a vote FOR this proposal.

|

The Audit and Risk Committee periodically reviews the engagement of the independent auditor to assess, among other things, the skills, experience, service levels and costs associated with conducting the annual audit of the Company’s financial statements. PwC has served as our independent auditor since March 2014.

| 20 | MSCI |

Proposal No. 1

Election of Directors

Our Board currently has 10 directors. Each director stands for election at each annual meeting of shareholders and holds office until his or her successor has been duly elected and qualified or the director’s earlier resignation, death or removal. All of the nominees presented beginning on page 14 of this Proxy Statement are directors of MSCI as of March 16, 2022. All directors, other than Rajat Taneja, were elected at the 2021 annual meeting of shareholders. The Board believes that each of the nominees brings strong skills and experience to the Board, giving the Board, as a group, the appropriate skills needed to exercise its oversight responsibilities and advise management with respect to the Company’s strategic initiatives. Each nominee has indicated that he or she is willing and able to serve if elected. We do not anticipate that any nominee will be unable or unwilling to stand for election, but if that happens, your proxy vote will be cast for another person nominated by the Board, or the Board may elect to reduce its size. VOTE REQUIRED AND RECOMMENDATION The affirmative vote of a majority of the votes cast with respect to each director’s election at our 2022 Annual Meeting is required to approve Proposal No. 1. Abstentions shall not be treated as votes cast. For additional information on the consequences for directors who do not receive a majority of the votes cast, please refer to “What happens if a director does not receive a majority of the votes required for his or her re-election?” in Annex A. | |||

| Our Board recommends that you vote “FOR” the election of all ten nominees named below. Proxies solicited by our Board will be voted “FOR” these nominees unless otherwise instructed. | ||

SEE PAGE 20

SEE PAGE 20

WHAT WE DO

WHAT WE DO

STARTS ON

STARTS ON STARTS ON

STARTS ON STARTS ON

STARTS ON